Many people experience emotional stress when thinking about their retirement. Simplicity is key to clearing their minds from doubts at the wrong moment. Having a plan is half the work. Here are four simple steps to make a plan with the help of AI to do the math we all hate for your specific case.

Nobody disagrees. We have doubts about our retirement funds. Do we have enough to enjoy a worry-free financial retirement? How much do we need then? When shall we retire?

Step one – How much income do you need when I retire?

What income do you need to retire? A common rule of thumb is to aim for 70-80% of your pre-retirement income to maintain your current lifestyle. For example, if you earn $100,000 annually, you might need $70,000-$80,000 per year in retirement.

Step two – How many years do you have to sort out this fund?

How many years do you have left to put it all together? If you are 38 years old now and want to retire at 65, you have 27 years to put it all together. Let’s assume you have $250,000 in investments in your pension, savings, and investment accounts; you need an additional $1,000,000.

Step three- How big should be your retirement fund?

How much of a retirement fund do you need to secure this income? If you never want to outlive your money? Because that would be a disaster – what can 87 years do to make additional income if needed? Likely not much.

A maximum spending rate of 4% a year is recommended if you want to live forever with a certain amount of money. So, assuming that, 25 times the retirement income you need. So, for every $ 50,000 you need $ 1,250,000.

Many financial advisors advise a lower multiplier: for instance, if you retire at 67, they recommend 11 times your last income. This assumption is based on a higher spending rate and an average life expectancy of 80 years old. Using that multiple, you only need $550,000 for every $50,000 income a year.

If you want to be on the safe side, I would consider that number a bare minimum and use the 25-times multiplier as a more realistic target. So, let’s use the multiplier of 25.

How much do you need to invest a month until retirement?

Here, it starts to get complicated, and at this point, most people get intentionally distracted. Most people cannot calculate how much you need to invest very month is needed to realize the required retirement sum. But, don’t worry about that! We have AI to sort this out for us. Let me show you how to do that.

We have decided on the fund size: $ 1,000,000. The investment horizon is 27 years. Then the only variable we still need, it the expected return we will make on your investments. What would that be? Let’s ask AI!

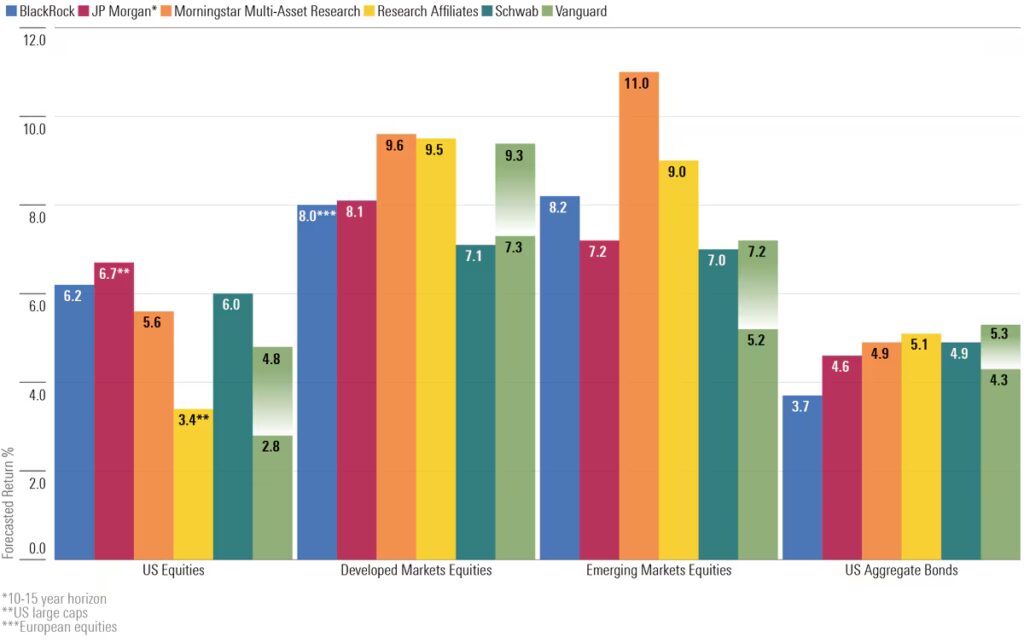

The expected return is a complex variable. In the last 25 years, returns on equities have been fantastic, but what will the coming 10 years bring? Let’s ask Microsoft Copilot:

Question 1: What are the expected returns on equities the coming 10 years?

Answer: The expected returns on equities over the next 10 years vary depending on the source and methodology used for the forecast. Here are some insights from different investment firms:

Vanguard: They forecast a nominal median US equity market return of 2.8%-4.8% during the next decade.

BlackRock: They expect a 6.2% 10-year nominal return for US equities.

Schwab: Their outlook shows a 6.0% nominal return for US large caps over the next 10 years.

Morningstar Multi-Asset Research: They predict a 5.6% 10-year nominal return for US stocks.

Question 2: Can you calculate the average percentage please?

Answer: Can you calculate the average percentage please?

Sure! Let’s calculate the average expected return on equities over the next 10 years based on the forecasts provided:

Vanguard: 2.8%-4.8% (average: 3.8%), BlackRock: 6.2%, Schwab: 6.0%, Morningstar Multi-Asset Research: 5.6%. To find the average, we sum these values and divide by the number of forecasts:

Average = 3.8 + 6.2 + 6.0 +5.6 / 4 = 21 .6 / 4 = 5.4 %

So, the average expected return on equities over the next 10 years is approximately 5.4%.

When you replace ‘equities’ with ‘bonds’ the outcome for that request is 4.65%.

Your investment horizon is very long, so let’s assume you have a portfolio with mostly equities—let’s say 80% equities and less bonds, let’s say 20% bonds. The expected return will be 0.8*5.4% + 0.2*4.65% = 5.25%.

To calculate how much you need to save every month, go to AI again:

Question: If I need $ 1,000,000 in 27 years and make 5.25% return a year, how much do I need to save a month from now?

Answer: To calculate how much you need to save each month to reach $1,000,000 in 27 years with an annual return of 5.25%, we can use the future value of an annuity formula. Then it shows all the formulas – but ignore and go to the final outcome: you would need to save approximately $982.57 per month to reach $1,000,000 in 27 years with an annual return of 5.25%.

Conclusion

Wow – that was easy and quick! How does that sound? Are you comfortable with this savings commitment? Start building wealth today. Read more? Order my book or book a coaching session!

Copilot – If you found this calculation helpful, you’ll appreciate using Copilot for your financial planning. Copilot is an advanced AI that provides instant solutions to complex financial questions, simplifying the management of your investments and savings. Try Copilot today and take control of your financial future with confidence! You can visit the Microsoft 365 Copilot website here to learn more.